Integrated report

Profile

Organisational overview and activities

- Business model

- Assurance

- History of the group

- Group at a glance

- Group structure of operating companies

- Location of operations

- Governance structure

Risks and opportunities

- Operating context

Strategic objectives

- Strategy

- Key performance indicators

Organisational performance

- Financial highlights

- Operational review and commentary

Future performance objectives

Remuneration

Organisational performance

Operational review and commentary

The group

The group’s markets are located predominantly outside of southern Africa. In protecting the interests of all the group’s stakeholders, management strives to ensure that the customer base is developed in a manner that does not expose it to levels of unacceptable risk. Management therefore ensures that the customer base is diversified on a global basis, taking into account regional economic stability and demand within the various economic regions, where acceptable levels of governance is evident. The impact of the factors that influence the extent of product sold, and the performance of the group on a per-commodity basis are more fully set out below. The group through its wholly owned subsidiary, Ore & Metal, is the sole marketing and distribution agent for all the group’s products, including those of Assmang, whose sales volumes for the current and previous year are as follows:

| 2011 | 2010 | ||

|---|---|---|---|

| metric | metric | % | |

| tons ’ 000 | tons ’ 000 | change | |

| Iron ore | 10 006 | 9 799 | 2 |

| Manganese ore* | 2 882 | 3 095 | (7) |

| Manganese alloys* | 218 | 238 | (8) |

| Charge chrome | 238 | 189 | 26 |

| Chrome ore* | 373 | 272 | 37 |

*Excludes intra-group sales to alloy plants.

Iron ore

Iron ore sales for the year increased marginally to 10,0 million tons (2010: 9,8 million tons), mainly due to the continuing demand from China, South Korea and Japan, as well as increased sales to the South African steel industry. European steel capacity utilisation has not completely recovered to its previous high level, and this market is expected to remain subdued for the short to medium term. Despite current uncertainty in the global market, market fundamentals for seaborne iron ore trade continue to remain strong, with spot prices continuing to rise during the year under review.

The past financial year saw the quarterly price mechanism, which uses indexed pricing used for price determination, find traction. Pricing mechanisms will continue to evolve, and a mix of quarterly, monthly and daily linked indexed pricing mechanisms will be used by most iron ore miners, depending on the target market. Currently, Assmang’s prices are largely based on quarterly contracts, while a small percentage consists of spot sales.

Zandspruit decline shaft at Rustenburg Minerals under construction.

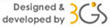

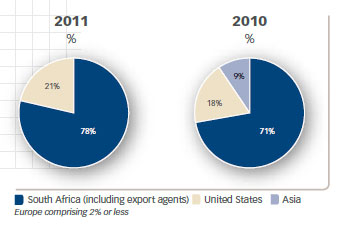

The increase in iron ore revenues for the year was mainly due to substantially higher prices for iron ore throughout the financial year. Strength in the iron ore price was driven by demand from China, where total steel production is expected to reach record levels during the current calendar year. Global crude steel production is projected at 1,5 billion tons (2010: 1,4 billion tons) for the calendar year. However, the effect of the higher iron ore prices on earnings was partly offset by the impact of the stronger rand, particularly in the second half of the year. The contribution to Assore’s headline earnings by Assmang’s Iron Ore Division increased to R2 326 million (2010: R718 million). The proportion of iron ore sales on a per-region basis for the current and previous financial years are illustrated as follows:

Prices for the short term are expected to remain at high levels, underpinned by the relative higher cost of iron ore mining in China, continued supply constraints and robust Chinese steel production. Sales volumes for next financial year are expected to increase in line with increased capacity achieved by the Khumani Expansion Project (KEP) and will ramp up in accordance with a planned increase in allocation on the iron ore rail line between Assmang’s Khumani mine and the Saldanha Bay port. Assmang and Transnet continue to negotiate increased capacity allocation for iron ore (and manganese ore) railed from the Northern Cape.

A total of R2,8 billion was spent on the ongoing infrastructural development at Assmang’s Khumani Iron Ore Mine, which will result in the mine capacity increasing to 16 million sales tons per annum from 1 July 2012.

Manganese ore and alloys

Manganese ore is mined by Assmang in the Black Rock area of the Northern Cape province and manganese alloys are produced at the Cato Ridge Works in KwaZulu-Natal. Cato Ridge Alloys, a joint venture between Assmang, Mizushima Ferroalloys Company Limited and Sumitomo Corporation Limited (both of Japan), produces refined ferromanganese by blowing oxygen through a lance into a converter which contains molten metal supplied by the Works, producing a product with a reduced carbon content. Ore-feed for the Works is almost exclusively sourced from Assmang’s manganese mines and the bulk of both ore and alloy production is exported. Manganese alloys are used in the production of steel, providing it with strength and a degree of malleability.

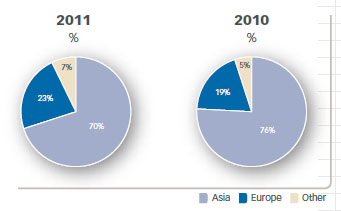

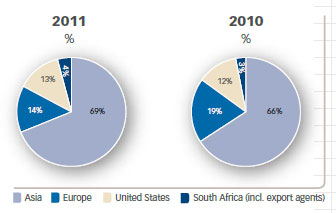

Steel production in Asia continued to post impressive gains throughout the year. However, in contrast crude steel production in North America and Europe only posted moderate gains as a result of the sluggish economic recovery in those regions. The main developing markets for manganese ore are in Asia, and China in particular, and despite increased demand from these markets, the price for manganese ore declined during the year under review from above US$7,00 per metric ton unit to US$5,30 per metric ton unit by the end of the financial year. Supply exceeded demand and inventory levels in China continue to be at record levels, resulting in continued pressure on prices. Towards the end of the year, it became evident that the new suppliers in the market were exporting lower volumes to China than expected, due mostly to lower revenues received on the back of the decreased prices for manganese ore. Manganese ore sales on a per-region basis for the current and previous financial years are illustrated as follows:

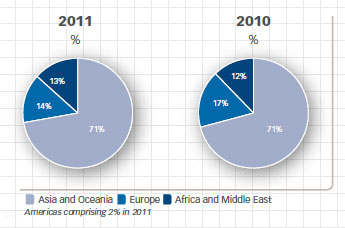

Manganese alloy prices in Europe and North America weakened during the year under review, as demand in these regions has not recovered to the same extent to which supply has increased. Even though supply of manganese alloys from China has dropped materially, other regions, notably the Ukraine and South Korea, have increased their exports significantly, which has maintained the downward pressure on prices. The proportion of ferromanganese sales on a per-region basis for the current and previous financial years is illustrated as follows:

Following the strategy of Assmang to optimise alloy production across its facilities, taking into account the expected future availability and cost of electricity, one of the ferrochrome furnaces (furnace No 5) at the Machadodorp Works was successfully converted to a high-carbon ferromanganese furnace. Further to this conversion, Assmang announced that two additional ferrochrome furnaces (furnaces 2 and 3) at the Machadodorp Works will be converted to high-carbon ferromanganese furnaces during the next year.

The lower sales volumes and prices for both manganese ore and alloys for the financial year 2011, resulted in the contribution to the headline earnings of Assore from this division declining to R685 million (2010: R740 million). Capital expenditure spent during the year in the manganese division amounted to R656 million (2010: R743 million), of which R313 million was spent on rebuilding ferromanganese furnaces with the most of the remainder being spent on surface development at the Black Rock Manganese operations and replacement expenditure.

Chrome ore and charge chrome

Chrome ore is mined at Assmang's Dwarsrivier Mine near Lydenburg in the Mpumalanga province and production is used mainly to supply Assmang's Ferrochrome Works at Machadodorp. The group also mines chrome ore near Rustenburg (Rustenburg Minerals Development Company (Proprietary) Limited) (Rustenburg Minerals) from established open-cast operations and an underground shaft, with a second underground shaft being commissioned by January 2012. In addition the group is undertaking open-cast chrome mining operations at Zeerust Chrome Mines Limited (Zeerust), which is located about 70km north of Zeerust in the North West province.

Rustenburg Minerals is 44% held by a black economic empowerment (BEE) partner, Mampa Investment Holdings (refer "Black Economic Empowerment Status report'). Production from Rustenburg Minerals is supplied mainly to the local market. Zeerust is 100% owned by Assore with all production currently being sold into the local market.

The bulk of chrome ore mined worldwide is converted to ferrochrome and utilised in the production of stainless steel. Since the world economic turmoil in 2008, the world market for stainless steel has experienced a strong recovery, with production in 2010 approximately 24% higher than calendar 2009. The stainless steel market remains split into two geographic areas, each with very different dynamics. During the year under review, Chinese production was more than 12 million tons, up over 70% on 2008 and as such, by far the largest stainless steel producer in the world. On the other hand, both the USA and Europe, the previous core stainless markets, continue to lag the Chinese market. Whilst the US has managed to show growth of some 14% for 2010 compared to 2008, Europe still remains approximately 5% below the level achieved in 2008, despite having grown over 25% compared to calendar 2009. These results mirror the relative GDP growth rates occurring in these two areas. Total world production of stainless steel for 2011 is expected to be around 3% above that of 2010, at approximately 32,5 million tons (2010: 31,7 million tons). Chrome ore sales on a per-region basis for the current and previous financial years are illustrated as follows:

Despite reasonable levels of demand for ferrochrome during the year under review, prices have tended to be relatively range bound, with South African producers continuing to act as swing producers, operating their furnaces to suit market conditions. This has been exacerbated by the increased cost of electricity, particularly during the winter months, when ferrochrome output was significantly reduced. In conjunction with other increased input costs and continued weak selling prices, the increased electricity prices have influenced Assmang’s conversion of one of the ferrochrome furnaces (furnace No 5) at the Machadodorp Works to ferromanganese production during the year under review and the subsequent decision to convert a further two ferrochrome furnaces (furnaces 2 and 3) during the first half of 2012.

Assmang’s charge chrome sales increased by 26% to 238 000 tons for the financial year (2010: 189 000 tons), while chrome ore sales increased by approximately 37% to 373 000 tons (2010: 272 000 tons). The proportion of ferrochrome sales on a per-region basis for the current and previous financial years are illustrated as follows:

Rustenburg Minerals produced and sold approximately 179 000 tons (2010: 216 000 tons) run of mine, lumpy and concentrate grades, and Zeerust produced and sold approximately 19 000 tons of concentrate in the financial year (2010: 4 000).

Wonderstone

Since 1937, the group has mined a type of Pyrophyllite which, for trade purposes, is referred to as Wonderstone. The deposit, which is located outside Ottosdal, approximately 300 kilometres west of Johannesburg, is of volcanic origin and displays unique corrosion, heat and abrasive-resistant properties. The bulk of the material mined is beneficiated and reworked into finished components for export to the USA and the United Kingdom. The components are utilised in various high-tech industrial applications, including the manufacture of synthetic diamonds and consumable products for the welding and electronics industries.

In addition, Alumina wear-resistant tiles are produced by Ceramox, a division of Wonderstone, which has shown significant sales growth over the past five years.

Wonderstone’s turnover for 2011 was R48 million (2010: R36 million), which realised a net profit of R2,6 million (2010: loss of R4,3 million), due to increased sales volumes, which were mostly driven by increased activity in oil drilling and exploration globally. In addition, the business model for production of the wear resistant tiles (ie the Ceramox division) has been rationalised, where increased focus has been placed on engineered tiles for cyclones and other applications.

Export sales demand for Wonderstone products from the synthetic diamond industry has been strong, and export selling prices have increased marginally on average across the range of products. It is anticipated that prices for the next financial year will remain strong, following indications from a number of customers, that additional capacity is being planned. The sales mix is still strongly focused on value-added machined components (at approximately 70% of sales), with the majority of customers based in the United States and in the United Kingdom. The remainder of the export sales consists mainly of rods, tubes and mined components.

Over the past year, Ceramox’s wear tile business has secured substantial project work through Group Line Projects (Proprietary) Limited (Groupline). These projects include Assmang’s Khumani Expansion Project (iron ore), the new Kumba Sishen South Iron Ore Mine (Kolomela Mine), the Moatize and Riversdale Coal Mine projects in Mozambique (both phase 1), the Mozambique Coal Export Terminal expansion project and the Medupi – Exxaro Grootegeluk Coal Mine expansion project. Ceramox had a total order commitment in the production of structural steel and industrial strike action prevented the fulfilment of all of these orders, and the balance of these orders (R17 million) is currently being completed.

Subsequent to the year-end, Wonderstone acquired Groupline, which specifies, selects and installs lining products to assist in solving a range of industrial flow and wear problems. Apart from being Ceramox’s largest customer, Wonderstone sees a good strategic fit between Groupline and its Ceramox wear tile production business that will strengthen both companies. It will create one company that can both supply and install flow and wear solutions to a range of industries, and will enable Ceramox to position its own, and Groupline’s, products and services closer to end customers, as well as growing its market share.

Marketing and shipping

Wholly owned subsidiary, Ore & Metal Company Limited, is responsible for the marketing and shipping of all the group’s products, including those produced by the three divisions of Assmang. Strong relationships have been established with customers in Europe, North America, South America, Africa, India and the Far East, and products with a market value of approximately R19,1 billion (2010: R12,1 billion) were marketed and distributed in these regions during the year. The company is an established supplier to steel and allied industries worldwide and has operated effectively in these markets for over 70 years. Commission income is based on the value of sales negotiated during the year and, due mainly to high prices for iron ore throughout the year, trading profit after taxation increased to R188 million (2010: R127 million) for the year under review.

Minerais U.S. LLC

The group holds a 51% share in Minerais U.S. LLC (Minerais) which is a limited liability company registered in the state of New Jersey in the United States of America (USA). Minerais is responsible for marketing and sales administration of the group’s products in the USA, in particular manganese and chrome alloys, and trades in other commodities related to the steelmaking industry. The contribution by the company to the group’s attributable profit amounted to R11 million (2010: R17 million).

Technical and operational management

As technical adviser to Assmang and other group companies, African Mining and Trust Company Limited provides operational management services to the group’s mines and plants. For these services it receives fee income based on turnover and commodity prices, with trading net profit after taxation for the year increasing to R134 million (2010: R82 million), also due mostly to the increased selling prices for iron ore across the year.

Investments

The group maintains a portfolio of listed shares which are selected and held in accordance with long-term investment criteria. Additions were made to the portfolio during the year at a cost of R42 million (2010: R21 million). The portfolio is valued in the financial statements at market value and the difference between cost and market value is transferred to other reserves net of any capital gains tax which would arise on eventual disposal. At year-end the market value of the portfolio was R887 million (2010: R603 million) based on a cost of R358 million (2010: R316 million). Dividends received on the portfolio for the year were R36 million (2010: R19 million).

Other income includes interest received of R133 million (2010: R191 million) generated on cash in excess of current requirements which was invested on a short-term basis in the money market. The reduction in the level of interest income was due mostly to lower levels of cash following the redemption during the year of the group’s preference share debt (refer note 18 to the consolidated annual financial statements).