Reviews and reports

Chairman’s review

Desmond Sacco Chairman

“The undoubted success for this year has been the group achieving record sales volumes of iron ore at a time when iron ore prices have been at their strongest.”

I am pleased to report that headline earnings for the financial year to 30 June 2012 have increased by 15,2% as compared with the previous year to an all-time record of R3,7 billion, due mainly to the significant increase in the earnings of Assmang Limited (Assmang). The increase in Assmang’s earnings was primarily due to higher sales volumes of iron ore and a weaker average rand/US dollar exchange rate across the year.

This year has been characterised by significant uncertainty in world financial markets. Sovereign debt issues, particularly in Europe and to a lesser extent in the United States, have persisted. Despite this, world steel production, which is the primary driver for the markets for the group’s products, has remained remarkably strong. Global production of steel in calendar 2011 was at a record level of just over 1,5 billion tons, with this level of production being maintained for the first half of 2012. However, signs of a long overdue cutback in Chinese production have become evident, together with significant slowdowns in other major steel producing regions. Despite the strong steel production, prices for the group’s products were generally weaker in US dollar terms than in 2011, as supply caught up with demand and negative economic sentiment became prevalent. These price reductions were partly compensated for by the weaker rand/US dollar exchange rate, particularly in the second half of the year when US dollar prices were generally lower than in the first half.

The year under review

The undoubted success for this year has been the group achieving record sales volumes of iron ore at a time when iron ore prices have been at their strongest. These sales volumes were 47% higher than the previous year, at nearly 14,8 million tons between the two iron ore mines, and were largely attributable to Assmang’s Khumani Expansion Project (KEP) being brought in on time and within budget. Khumani Iron Ore Mine now has the capacity to produce 14 million tons of iron ore per year for the export market, in line with Assmang’s rail allocation.

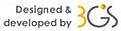

The group’s prime focus remains its 50% shareholding in Assmang and the commissions and other income derived from marketing the group’s products and providing technical and management services to group companies. The impact of the increased sales volumes of iron ore, together with the similar rand prices for the group’s products and the mix of sales volumes for the remainder of the group’s commodities, is shown in the bar chart below, which indicates the contribution to the group’s headline earnings over the past five years by commodity and the group’s relative exposure to these markets. The change in the mix of the contribution by the respective commodities over the past two years is mainly due to the increased volumes and high prices of iron ore. Prices for iron ore have since declined, which will result in a more balanced contribution, particularly from manganese.

Capital expenditure

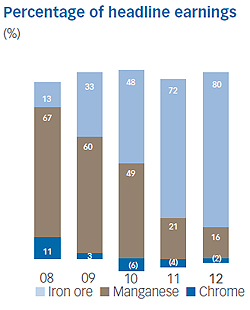

The bulk of the capital expenditure occurs in Assmang, in which the group has a 50% interest and amounted to R4,5 billion (2011: R4,1 billion) for the year under review. R3 billion was spent at the Khumani Iron Ore Mine, which included R1,3 billion on the Khumani Expansion Project, and R1,2 billion on mine development, largely on waste-stripping.

Assmang’s manganese ore mines spent R450 million, most of which was on replacement capital items and additional mobile mining equipment. Transnet’s growth strategy includes a target of increasing manganese ore export capacity to 12 million tons per annum for all manganese producers on the rail corridor from the Northern Cape to a new manganese terminal at Coega port near Port Elizabeth, which is due to be completed by 2017/18. R86 million was spent during the year on feasibility studies to enable the mines to sustainably produce four million tons per annum, and thereafter to expand to five million tons per annum, which includes a replacement shaft at the Gloria Mine and expenditure to address increased tramming distances. In total, it is estimated that this project may cost in the region of R5,6 billion. However, the decision on the expansion will depend on the availability of adequate rail capacity and on the market.

The conversion of two ferrochrome furnaces to ferromanganese furnaces at Machadodorp Works continues and it is expected that the furnaces will be commissioned in the third calendar quarter of 2012. The total cost to complete the conversion and associated upgrade of the infrastructure is estimated at R600 million.

Assmang has spent approximately R17,6 billion in capital over the past five years, and capital expenditure is summarised by division for the past five years as follows:

Black economic empowerment

During the year, the group restructured its HDSA control and ownership, and is pleased to be in the position in which all of its BEE shareholding, as required by the Mining Charter, is broad-based, resulting in benefits flowing to the communities in the areas in which our mines operate. It provided the group with a further opportunity to implement a scheme for our non-managerial staff to participate in the company’s dividends and capital appreciation through the Assore Employee Trust (refer “Black economic empowerment status report”).

Dividends

As mentioned, the group’s earnings for the year were at record levels, and the board increased the interim dividend to 250 cents (2011: 200 cents) per share, and increased the final dividend to 300 cents (2011: 250 cents) per share. The total dividend for the year therefore amounts to 550 cents (2011: 450 cents) per share, an increase of 22%, part of which was in recognition of the introduction of dividends tax.

Outlook

Further to the results announcement in August, European sovereign debt issues are still prevalent in the global markets in which the group operates and are negatively impacting steel production in Europe, and to a lesser extent in the United States. Lower demand in China more recently has placed additional pressure on prices of the group’s products in that region. In addition, significant global and local political events are due to take place before the end of the calendar year, the uncertainty of which is impacting global economic growth negatively and is creating further downward pressure on prices for the group’s products.

The group is mindful of recent cost increases for labour in South Africa, and is closely monitoring developments in this respect. Continued above-inflation increases in electricity costs have, in part, also necessitated realignment of alloy production.

These factors, together with volatility in exchange rates, make it difficult to comment with any confidence on the performance of the group in the short and longer term.

Directors

Following his indicated intention to resign from the board in September 2011, Dr Johannes van der Horst resigned with effect from 31 December 2011. We are grateful for the invaluable contribution he made over the combined 17 years that he served on the Assore board.

On 1 November 2011, Ms Zodwa Manaze resigned from the board, due to a potential conflict of interest, while on 3 May 2012, Mr Don Ncube resigned as a director.

After the year-end, Mr Phil Crous indicated his intention to resign from the board with effect from 31 August 2012. Phil served on the board as Group Technical and Operations Director for 19 years, during which he made a significant contribution to the group. Headline earnings rose from R38,5 million to R3,7 billion over this time.

On 1 September 2012, Mr Alastair Stalker was appointed to the board as Group Marketing Director, and Mr Tiaan van Aswegen was appointed as Group Technical and Operations Director. Both Alastair and Tiaan were previously appointed as alternate directors, and have served the group for 18 and nine years respectively in various senior positions. The board welcomes them both, and looks forward to their contributions in the future.

We welcome Mr Sydey Mhlarhi to the board who has agreed to join the board with effect from 15 October 2012 as an independent non-executive director and as a member of the Audit and Risk Committee. Sydney, who is a chartered accountant, is a founder and director of Tamela Holdings Proprietary Limited, and has extensive banking and financial experience.

Appreciation

The achievement of record profits for the year has been made possible by the significant contribution by management and members of staff, in very challenging market conditions. I am grateful for the efforts of all within the group who have contributed to these results, as well as for the continued support received from our partners, customers, suppliers, shareholders and bankers.

Desmond Sacco

Chairman

19 October 2012