Reviews and reports

Chairman’s review

Desmond Sacco Chairman

"…this financial year has seen exceptionally high prices for iron ore."

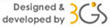

Earnings for the financial year to 30 June 2011 have increased by 117,6% on the previous year to R3,2 billion due mainly to the significant increase in the earnings of Assmang Limited (Assmang), resulting from the stronger demand for all group products and in particular substantially higher prices for iron ore across the year. Strength in the iron ore price was driven by demand from China where crude steel production is expected to reach record levels during the current calendar year.

The year under review

This year has seen the level of earnings return to levels experienced before the start of the world economic turmoil that set in towards the end of calendar 2008. While previous levels of earnings were largely attributable to a combination of a weaker rand and high commodity prices, this financial year has seen exceptionally high prices for iron ore. However, the impact of these higher prices and additional sales volumes was partly offset by the strong level of the rand, particularly in the second half. The increased demand for iron ore is due to record levels of global steel production experienced in the first half of the 2011 calendar year, of which China’s proportion amounted to 47%. Prices for other commodities were generally range-bound during the year, given that most markets for these commodities were reasonably balanced throughout the year. The group’s results for the past five financial years, on a six-monthly basis, are as follows:

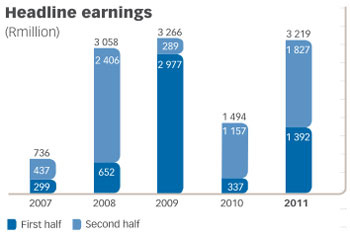

The group’s prime focus remains its 50% shareholding in Assmang and the commissions and other income derived from marketing the group’s products and providing technical and management services to group companies. Assmang’s Khumani Expansion Project (KEP) has to date proven to be very successful, and the investment in the project (refer “Capital expenditure” below), which to date has provided the mine with the ability to produce 10 million tons of export sales annually, from its previous base of six million tons, has changed Assmang’s earnings profile significantly. Additional mining infrastructure is being developed, and the additional capacity to rail the resultant planned annual export tonnage of 14 million tons is currently being negotiated with Transnet. The contribution from Assmang to Assore’s headline earnings by commodity for the past five years on a percentage basis is as follows:

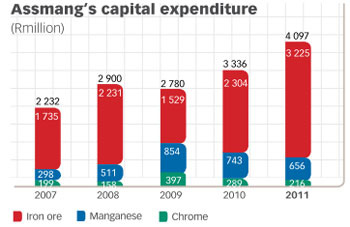

Capital expenditure

The bulk of the group’s capital expenditure occurs in Assmang, with R4,1 billion of capital being spent across its operations (2010: R3,3 billion) during the year. Of this amount R2,8 billion was spent on infrastructural items on the KEP, which will enable the mine to realise sales of 16 million tons of iron ore per annum. This project remains on schedule, and the mine is expected to achieve this level of production as from 1 July 2012.

Following the successful conversion of a ferrochrome furnace at the Machadodorp Works to a ferromanganese furnace, two additional furnaces are scheduled to be converted on this basis as well. Production of ferromanganese is expected to start towards the middle of calendar 2012. Approximately R656 million of capital was spent in Assmang’s Manganese division during the year, of which R313 million was utilised on rebuilding furnaces, with most of the balance spent on surface development of the new plant at the Black Rock Manganese Ore Mine and ongoing replacement expenditure.

The development of two underground shafts at Assore’s chromite mine, Rustenburg Minerals, continues, and during the year, R38 million was spent on the development of these shafts, which are expected to be operational by July 2013.

Assmang’s capital expenditure is summarised by division for the past five years as follows:

Dividends

Following the stronger financial results, the board doubled the level of the interim dividend for the year to 200 cents (2010: 100 cents) per share.

Due to the sustained level of earnings in the second half of the year, a final dividend of 250 cents (2010: 240 cents) per share was declared, resulting in the total dividend per share for the year amounting to 450 cents (2010: 340 cents), an increase of 32%.

Outlook

As noted in the results announcement in August, significant uncertainties still exist in the global economy with the United States and Europe showing little sign of sustainable recovery. Continued economic growth in Asia, and in particular China, is largely responsible for continued high iron ore prices. The indications are that these prices are sustainable and will be a feature of the commodities market for at least the short term. The oversupplied position in the manganese and chrome markets remains evident, and current global economic uncertainties do not provide the conditions necessary to command higher ore and alloy prices for these commodities.

Cost increases in South Africa are placing further pressure on most of the group’s alloy products, which is necessitating the careful review of the cost-effectiveness of the group’s operations, particularly in the manganese and chrome alloy plants. These factors, and the fact that the group’s results are directly affected by the level of the rand, do not make it possible to predict the results of the group with any certainty.

Directors

Subsequent to the year-end, and upon the completion of the first phase of our third empowerment transaction, the Shanduka Group disposed of its 11,8% interest in Assore (refer “Black Economic Empowerment Status report”), and Cyril Ramaphosa resigned as non-executive director.

On 3 May 2011, Don Ncube was appointed as an independent non-executive director. Don has sat on the boards of a number of South African corporates and was inter alia non-executive chairman of South African Airways, Sun International SA and the Atomic Energy Corporation. He is currently on the boards of Goldfields Limited, Vula Mining Supplies and Badimo Gas, of which he is the executive chairman and is eminently placed to make a valuable contribution to the group.

We welcome Ms Zodwa Manase to the board who has agreed to join the board with effect from 7 October 2011 as an independent non-executive director. Zodwa is the chairperson of Total South Africa and the State Information Technology Agency, and holds directorships in Medi-Clinic Corporation Limited and MTN Zakhele.

Appreciation

Despite the buoyant conditions in the iron ore market, this year has been difficult for the group and its staff, particularly those involved and responsible for sales of other commodities. I thank my fellow directors, the management and staff for their ongoing support and commitment during the year. In addition, the value and input received from our customers, agents, suppliers, shareholders and bankers have further enhanced the group’s achievements and receive our appreciation.

Desmond Sacco

Chairman

14 October 2011